The South African government has become increasingly reliant on personal income tax as a source of revenue and a recent report on the latest national tax data from Stats SA shows that SA locals are among the world’s highest taxpayers.

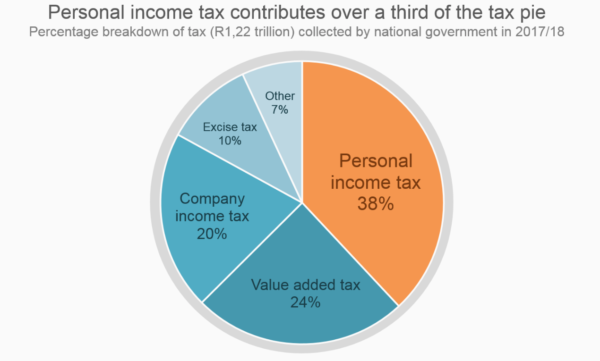

From 2017 to 2018, personal income tax accounted for R1.22-trillion in taxes collected by the national government and ranks as the country’s number-one source of tax, accounting for 38% of all tax revenue. Just behind this is value added tax or VAT accounting for 24%, followed by company income tax, which accounts for 20%.

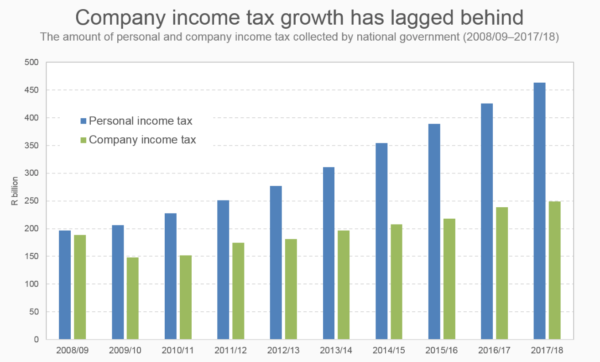

Just ten years ago, the amounts were much lower and personal income tax only accounted for 31%, while company income tax accounted for more at 30%.

This shift in tax percentages is due in part to the 2008 to 2009 economic recession which reduced the revenue from company income tax and caused the percentage collected to grow much more slowly than personal income tax.

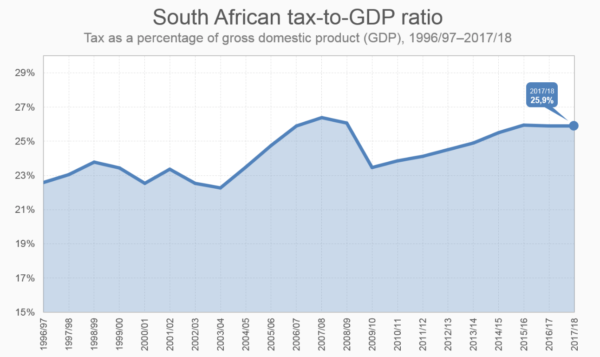

Despite weak economic growth in the country over the years, tax revenue has continued to grow. The tax-to-GDP ratio shows just how excessive the tax burden in South Africa is, with 2017 to 2018’s ratio being 25.9%. The higher the percentage, the higher the amount of tax collected relative to the size of the economy.

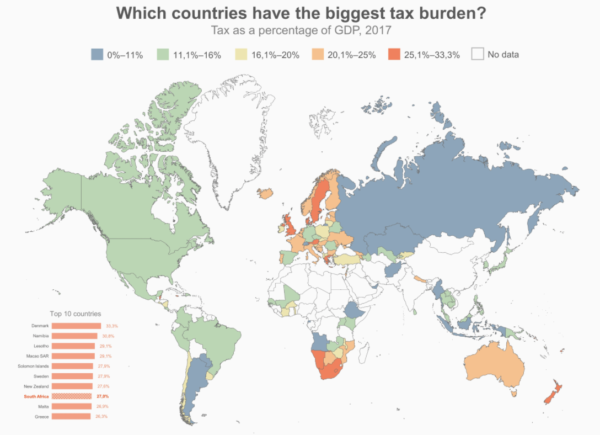

Because of these excessive figures, South Africa finds itself among the world’s top-ten-highest-taxed countries in the world according to the International Monetary Fund (IMF).

Out of 115 countries with substantial tax data, South Africa ranks as the 8th-most-taxed country in the world, just behind New Zealand and Sweden. Namibia and Lesotho are even more highly taxed, however, featuring in second and third place just behind Denmark which took the top spot as the world’s most taxed country.

The world average for tax according to the IMF was 15.4% in 2017 and South African residents pay more taxes than the United Kingdom (25.7%), Australia (22.2%), Brazil (12.7%) and the United States (11.9%).

This surely comes as no surprise to South Africans, who feel the burden of taxes each month and feel nothing is really being done with all the money that is being taken from them.

Countries mentioned on the list with particularly high GDP-to-tax ratios are not as badly off, as although the taxes are high, these countries also offer some of the highest living standards in the world as well as various free services such as health care and schooling, but South Africa cannot say the same.

At the same time a low tax-to-GDP ratio demonstrates an inefficient tax system and can have negative effects on a country and cause problems with service delivery or public space and building maintenance.

Steep tax percentages alone do not demonstrate anything; rather it is what each country does with the taxes and how they serve their populace with the money they receive from residents. It goes without saying that South Africans do not feel their tax money is being used correctly and are concerned that personal income tax percentages may continue to grow irrespective of the country’s economic state.

Picture: Pexels